– Crude

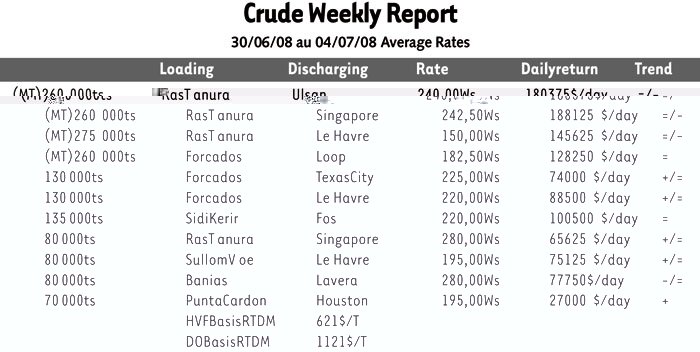

With the start of the busy summer driving season, oil prices are still creeping up with the index getting close to US$150. Bunker costs have jumped this week by more than US$50/ton and are now above US$700/t at Rotterdam! However, these extremely heavy operational costs are still largely compensated for by the current freight levels on all sizes of ships. The VLCC market has registered a quieter tone these last few days with less than 20 fixtures concluded from the Middle East Gulf. Owners are still enjoying their best results on voyages to the East, with rates around WS240 (about US$185,000/day), while to the West the current slightly lower demand has brought rates back to WS145 (about US $140,000/day). Depending when the first cargoes for August will be allocated, we may see this market holding stable next week. In the Atlantic basin, the recent pick-up in activity for the Suezmax sizes has helped the few VLCCs still available for end July. The market gained 20 points, ending the week at WS182.5 (close to US$130,000/day) for a voyage West Africa to the US Gulf. After having dipped just below WS200, the West Africa Suezmax market remained lively and as a result climbed approximately 30 points, with a series of fixtures concluded around the WS230 level for UK/Cont Med discharge (WS240 for Brazil) The week ended on a quiet note with the USA closed on Friday. However with charterers already working to August dates, rates look unlikely to slip. At WS225, owners’ daily returns for a West Africa/ US Gulf round voyage are just below US$75,000/day. The Black Sea/Med market was fairly active but actually experienced a slight softening down to the WS215 level. However with West Africa picking up quickly and long haul voyages still taking vessels open in the Med out of the market for a while, rates firmed back up to WS225 levels, and have yet to be re-tested. At WS225, rates for Novo/Augusta return close to US$80,000/day. The Aframax market started with the same sluggish undertone as the end of last week but the clouds quickly passed. Demand in Europe revived rapidly, and with fears over strikes/delays in France, rates were not only pushed back to the levels they were a few days before, but came further up. After the Mediterranean registered a temporary plunge to the WS160 level, rates rose to WS280 (TCE about US$77,000/day) on the back of plentiful demand for mid-July loading. To a lesser extent, the North Sea/Baltic and Caribs players also saw their returns reduced before the action pushed the respective freight levels up to about WS200, but the DNR in these two markets remains very diverse, giving about US$75,000/day TC return in Northern Europe, compared to a mere US$27,000/day in the Caribs. The East of Suez rates increased without too big a surprise as ships were starting to be scarce for July loading, both in theMiddle and Far East.

– Products

Despite the few fixtures concluded this week in the East of Suez market, rates remain at very high numbers with MR again gaining the most. LR1 have showed a potential weakening due to the number of vessels still unfixed in July, but owners managed to maintain rates as per last week at WS300 for the LR1, and WS255 for the LR2. MR cargoes were very few in number and ships were even more scarce, which made the week relatively calm, but rates went up with US$500,000 rumoured for cross-Gulf and above WS400 for MEG/East Africa. The Far East market has also been active with WS325 done on 30,000 t SingaporeJapan. We believe the market will remain strong for the next couple of weeks. The downward trend was confirmed this week with very limited demand, and growing tonnage availability. Several owners, including traders and oil company relets, struggled to fix their ships trading spot in the area, resulting in a strong fall in freight rates. The freight rates came down to WS350 minimum Aghioi Theodoroi for the Black Sea/Med and WS340 for cross-Med. No real sign of recovery is foreseen, so rates are bound to decrease further. Following the general trend of the clean market, theHandies in North West Europe were quiet, with rates now at WS275 basis 22,000 t and 30,000 t for cross UK/Cont or Baltic/Cont. The MR transatlantic market stayed stable at WS360 basis 37,000 t and UK-Cont/West Africa voyages were fixed at WS350 basis 33,000 t. However, some owners are anticipating a low market for the coming weeks and are keen to secure some long haul voyages.